Northland M&A Market Remains Strong; Slip in Volume Reflects National Trend

by Bill Jarrett

Managing Director, TrueNorth Capital Partners

This article updates last year’s review (April 1, 2016) of the forces and trends that shaped M&A activity within the Northland Region since the Great Recession.

Minneapolis, MN, May 2017 – In many respects, the M&A market continues to be strong and enjoys good prospects. Valuation multiples remain high. The stock market is near record highs and interest rates remain low. The demand for acquisitions, fueled by the ample and growing cash and financial resources of corporate and financial buyers, is strong. In our nation’s slowly growing economy, corporations and portfolio companies of private equity groups are almost desperate to accelerate revenue growth via acquisitions. Despite these market strengths, in terms of deal activity, the M&A market saw a modest decrease (4.2%) in 2016, and this downturn extended into the first quarter of 2017. Not surprisingly, the national decline in transaction volume is reflected in the M&A market activity for the Northland Region (which is comprised of the five states surrounding the Twin Cities of Minneapolis and St. Paul).

Minneapolis, MN, May 2017 – In many respects, the M&A market continues to be strong and enjoys good prospects. Valuation multiples remain high. The stock market is near record highs and interest rates remain low. The demand for acquisitions, fueled by the ample and growing cash and financial resources of corporate and financial buyers, is strong. In our nation’s slowly growing economy, corporations and portfolio companies of private equity groups are almost desperate to accelerate revenue growth via acquisitions. Despite these market strengths, in terms of deal activity, the M&A market saw a modest decrease (4.2%) in 2016, and this downturn extended into the first quarter of 2017. Not surprisingly, the national decline in transaction volume is reflected in the M&A market activity for the Northland Region (which is comprised of the five states surrounding the Twin Cities of Minneapolis and St. Paul).

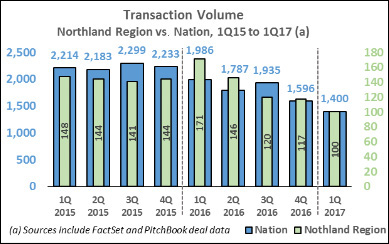

The Significant, Unusual, and Temporary Divergence of the Stock and M&A Markets. Since the election of Donald Trump six months ago, stock prices have pushed to record highs. Any Trump effect on the stock market, however, has not benefited the M&A market – so far. National M&A activity transaction activity is down substantially in the last two quarters, from 1,935 transactions in the third quarter of 2016 to 1,400 transactions in the first quarter of 2017 (nearly a 30% decline). To be fair, most owners of companies who have decided to sell their companies since the presidential election have yet to complete these transactions. For the fundamental economic reasons cited above, however, the trend line for M&A market activity is likely to “return to the norm” whereby stock market price indices and M&A market activity move more in tandem rather than in different directions.

as outperformed the nation with respect to M&A market activity. But, beginning at the end of 2015, M&A activity in the national and Northland Region markets turned down. As shown in the nearby table, whereas 2015 quarterly M&A transactions – both nationally and regionally – were stable, quarterly deal activity generally declined during 2016. And this trend continued during the first quarter of 2017.

as outperformed the nation with respect to M&A market activity. But, beginning at the end of 2015, M&A activity in the national and Northland Region markets turned down. As shown in the nearby table, whereas 2015 quarterly M&A transactions – both nationally and regionally – were stable, quarterly deal activity generally declined during 2016. And this trend continued during the first quarter of 2017.

Due to the spike in Northland M&A activity in the first quarter of 2016 (171 transactions, which were up 18.5% vs. the 2015 average quarterly transactions for the Northland Region of 144 transactions), this region’s downward trend in quarterly M&A activity began somewhat later than the national downward trend. This same spike in Northland Region transactions also caused the decline in this region’s quarterly M&A transactions during 2016 to appear to be steeper than the national trend. Given, however, the greater variability in quarterly results for a region that accounts for substantially less than 10% of the national market, this unusual regional spike doesn’t merit any substantive conclusions other than both markets have experienced meaningful declines in quarterly transaction volume in the past year or so.

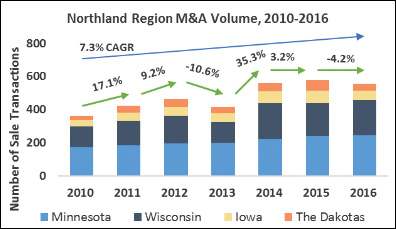

Minnesota and Wisconsin, M&A Leaders in the Northland Region, Together Showed a Modest Gain in 2016 M&A Activity. As shown in the table below, the recent decline in Northland Region M&A activity is primarily attributable to the pronounced downturn of 2016 M&A activity in the three western and smaller states of the region (Iowa and the Dakotas). In contrast, the M&A activity in the region’s two largest states (Minnesota and Wisconsin) showed a slight increase. Together, these two states accounted for 457, or 82%, of the region’s 554 completed transactions in 2016. These totals were up 3.9% from 2015.

This modest uptick in 2016 M&A volume in Minnesota and Wisconsin, however, did not continue into the first quarter of 2017. During the first quarter of 2017, just 86 transactions were completed in Minnesota and Wisconsin – a significant decline (18.6%) from the average of 106 deals completed in these two states during the final three quarters of 2016. The bulk of this decline can be attributed to the much lower deal activity in Minnesota during the first quarter of 2017.

This modest uptick in 2016 M&A volume in Minnesota and Wisconsin, however, did not continue into the first quarter of 2017. During the first quarter of 2017, just 86 transactions were completed in Minnesota and Wisconsin – a significant decline (18.6%) from the average of 106 deals completed in these two states during the final three quarters of 2016. The bulk of this decline can be attributed to the much lower deal activity in Minnesota during the first quarter of 2017.

Weakened Economic Conditions in Region’s Agriculture and Energy Sectors. The economies of Iowa and the Dakotas are much smaller than the economies of Minnesota and Wisconsin and are more highly dependent on the agriculture and energy sectors. Consequently, these sectors drive M&A activity in Iowa and the Dakotas and this activity has been volatile. In the five years ended with 2015, M&A activity in these western states of the region grew relatively quickly – in large part due to the rapid expansion of the North Dakota fracking industry. After this rapid growth, the cyclical downturns in the agriculture and energy markets have led to a rapid descent in 2016 M&A activity. Together, these three states accounted for 138 transactions in 2015 and 97 transactions in 2016, a near 30% decline. This decline more than offset the modest increase in M&A activity of Minnesota and Wisconsin, resulting in an overall annual decline in 2016 M&A activity in the Northland Region of 4.2%.

Weak M&A Activity in the Consumer & Retail Sector of the Northland Region. At TrueNorth Capital Partners, a boutique investment bank with offices in Stamford, CT, Minneapolis, MN, and Charlotte, NC, we are active on three broad sectors: Industrial & Manufacturing, Business Services & Distribution, and Consumer & Retail. Since 2010, M&A activity in all three of these sectors contributed to the relatively strong growth of M&A activity in the Northland Region. Accordingly, transactions in this region’s Consumer & Retail sector grew from 57 in 2010 to 109 in 2015. In 2016, however, there was a sharp decline of M&A activity for this sector – falling back to 60 transactions in 2016, a 45% year-over-year decline. This sharp decline, which continued in the first quarter of 2017 to only 8 transactions (32 transactions on an annualized basis), can be attributed in part to the spike in such transactions in 2015 (from 86 in 2014 to 109, a 27% increase) and in part to the economic disruption of this sector caused by the migration of the consumer from “brick & mortar” retail shopping to the Internet.

Northland M&A Volume Expected to Bounce Back. Since 2010, the transaction volume in the Northland Region has grown at a compounded annual growth rate (“CAGR”) of 7.3%, well above the national CAGR of 4.4%. During this time period, the Northland Region experienced only one other decline in annual M&A activity – in 2013. In the following year, the annual growth of Northland Region M&A activity snapped back to an astonishing 35%. Given the 2016 decline in the region’s M&A activity, history suggests that M&A will bounce back in 2017. So far, however, this has not been the case as first quarter M&A activity in the Northland Region continued to decline. But the year is still young and the fundamentals are in place for M&A activity in the Northland Region to soon turn north again.